Prestige Kingfisher Towers Bangalore

RERA No.: On Request

RERA No.: On Request

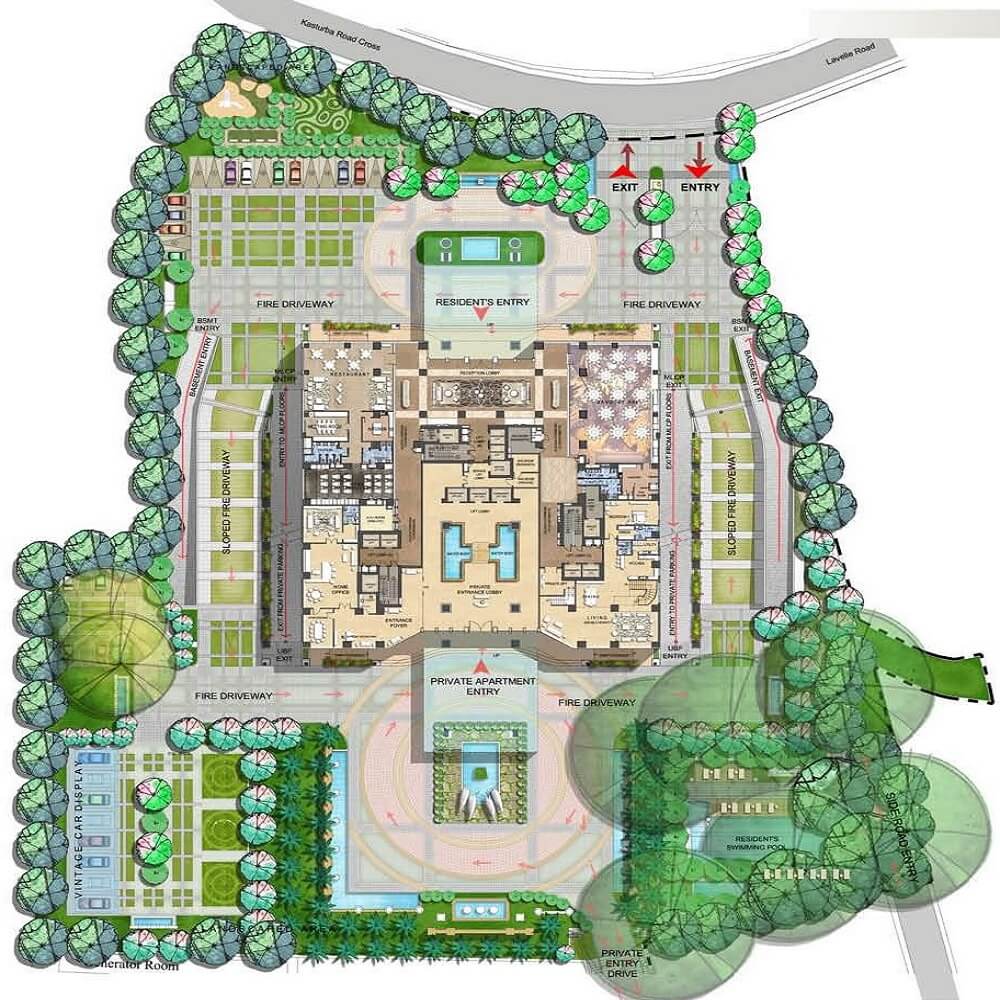

Project Area : 4 Acres

Buildup area: 8321 Sq.Ft

Type : 4 BHK

Price : ₹ 30 Cr* Onwards

No.of Unit : 42 Units

Status: Completed

Prestige Kingfisher Towers is an ultimate reflection of the urban chic lifestyle located in Ashok Nagar, Bangalore. The project hosts in its lap exclusively designed Residential Apartments, each being an epitome of elegance and simplicity inspiring in design, stirring in luxury and enveloped by verdant surroundings

Intercom

Intercom

Power Backup

Power Backup

Kids Play Area

Kids Play Area

Swimming Pool

Swimming Pool

kids pool

kids pool

Indoor Games Room

Indoor Games Room

Jogging Track

Jogging Track

Gymnasium

Gymnasium

Aerobics Space

Aerobics Space

Squash Court

Squash Court

Tennis Court

Tennis Court

Meditation Hall

Meditation Hall

Table Tennis

Table Tennis

Rain water Harvesting

Rain water Harvesting

Health Facilities

Health Facilities

Badminton Courts

Badminton Courts